Switzerland’s strategic location, robust economy, and transparent regulatory environment make it an attractive destination for foreign entrepreneurs. Non-residents interested in opening a business in Switzerland will find a highly organized system with clear requirements. From selecting the right legal structure to appointing a Swiss resident director, this guide covers everything you need to navigate the Swiss business landscape as a non-resident.

Why Switzerland is a Prime Location for Non-Resident Entrepreneurs

Switzerland’s appeal extends beyond its reputation as a financial hub. The country offers a secure business environment, an educated workforce, and favorable policies that make it a welcoming place for businesses of all types and sizes. Here’s why foreign entrepreneurs consider Switzerland:

- Economic Stability: Switzerland has a strong, stable economy that supports long-term business growth.

- Proximity to Key Markets: Located at the heart of Europe, Switzerland offers easy access to major European markets.

- Tax Efficiency: With competitive corporate tax rates and tax treaties with many countries, Switzerland can be tax-efficient for both domiciliary and operational businesses.

Non-residents who wish to open a business in Switzerland must understand specific legal structures, residency requirements, and tax obligations to ensure a smooth setup.

Choosing the Right Business Structure: Domiciliary vs. Operational Companies

One of the first steps for foreign entrepreneurs is to choose between a domiciliary or operational company structure, as this choice impacts tax obligations, regulatory requirements, and residency needs.

Domiciliary Companies

A domiciliary company is typically established by international businesses for asset management, holding functions, or specific non-operational purposes. These companies have minimal or no physical presence in Switzerland and are primarily focused on managing international transactions rather than providing goods or services directly within the Swiss market.

- Use Case: Ideal for asset management, intellectual property holding, or global transactions.

- Tax Implications: Domiciliary companies benefit from favorable tax rates since most of their revenue is generated outside Switzerland.

- Residency Requirements: Non-residents must appoint a Swiss resident director to manage compliance with Swiss laws.

Operational Companies

An operational company engages directly in business activities within Switzerland. These companies usually have a physical office, employ staff, and provide products or services locally. Operational companies are commonly chosen by entrepreneurs who wish to expand directly into the Swiss or broader European market.

- Use Case: Suitable for businesses providing services or products within Switzerland, such as consulting, tech startups, or retail.

- Tax Implications: Subject to regular federal, cantonal, and municipal taxes, as they generate income within Switzerland.

- Residency Requirements: Like domiciliary companies, operational companies also require at least one Swiss resident director.

| Type of Company | Suitable For | Residency Requirement | Tax Rate Impact |

|---|---|---|---|

| Domiciliary Company | Asset management, intellectual property | Swiss resident director | Favorable tax rates for mostly non-Swiss income |

| Operational Company | Service, retail, consulting | Swiss resident director | Standard corporate tax rates on Swiss income |

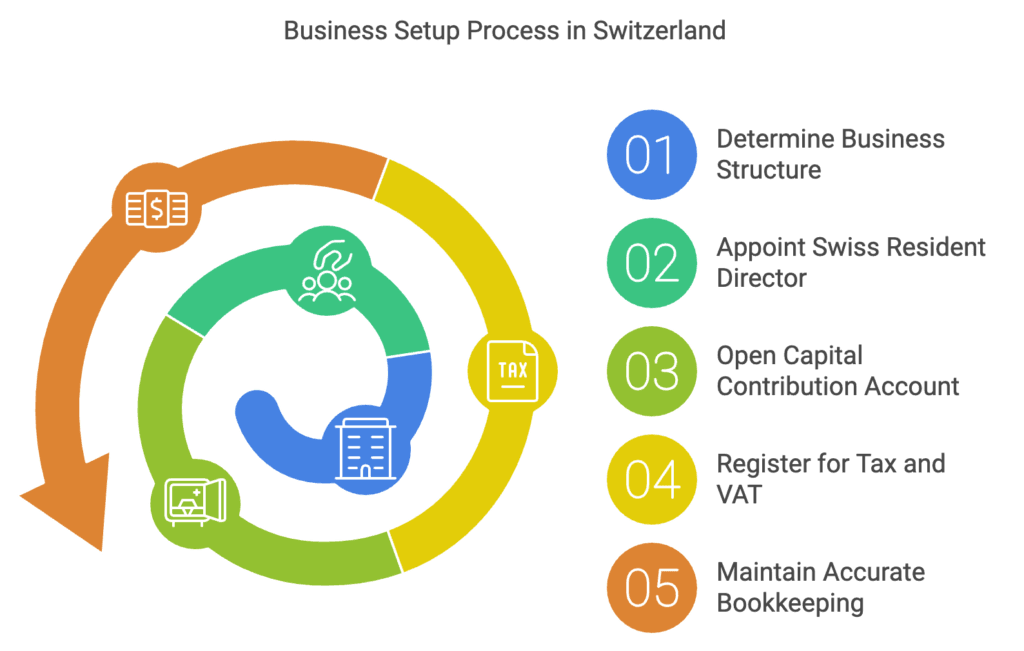

Key Steps and Legal Requirements for Non-Residents

Once you’ve chosen the right business structure, there are specific steps and legal requirements to fulfill as a non-resident entrepreneur.

1. Appointing a Swiss Resident Director

For compliance purposes, Swiss law requires non-residents to appoint at least one Swiss-resident director for certain types of companies, such as Limited Liability Companies (GmbH) and Corporations (AG). The Swiss resident director serves as the legal representative of the business, ensuring it meets all regulatory obligations within Switzerland.

- Domiciliary Companies: The resident director provides local oversight and accountability, even if the business’s primary activities are outside Switzerland.

- Operational Companies: The resident director manages daily compliance and ensures that local operations adhere to Swiss regulations.

2. Opening a Capital Contribution Account

For non-residents establishing a GmbH or AG, opening a capital contribution account is mandatory. This account holds the initial share capital required to form the company, ensuring financial stability as the business gets started.

- GmbH Requirement: Minimum share capital of CHF 20,000.

- AG Requirement: Minimum share capital of CHF 100,000, with at least CHF 50,000 paid in upfront.

Opening a capital contribution account as a non-resident may involve additional compliance checks due to Swiss banking regulations, which prioritize Know Your Customer (KYC) standards. Some banks, like CIM Banque, have experience working with foreign-owned businesses and may offer flexible solutions, though fees can reach up to CHF 1,200 for account setup.

Understanding Swiss Taxation and Compliance for Non-Residents

Switzerland’s tax system is a critical factor for foreign entrepreneurs, especially since tax obligations vary significantly between domiciliary and operational companies.

Corporate Tax Rates and Compliance

Switzerland’s tax rates differ by canton, but corporate tax generally includes federal, cantonal, and municipal components. Here’s an overview of the tax impact for domiciliary versus operational companies:

- Domiciliary Companies: Domiciliary companies often receive favorable cantonal tax treatment, as they primarily generate income outside Switzerland. This can lead to significantly lower effective tax rates.

- Operational Companies: Companies engaged in Swiss business activities are subject to regular tax rates. Additionally, operational companies may need to register for VAT if their revenue exceeds CHF 100,000 annually within Switzerland.

Financial Reporting Requirements

All companies in Switzerland must maintain accurate bookkeeping records, but audit requirements vary based on the size and nature of the business:

- Annual Financial Statements: Companies must prepare annual financial statements, which are reviewed internally or for tax filing purposes. These statements are not filed publicly but are essential for tax compliance.

- Audit Requirements:

- Ordinary Audit: Required for large companies meeting two of the following three criteria: CHF 20 million in total assets, CHF 40 million in revenue, or an average of 250 full-time employees.

- Limited Audit: Smaller companies may only require a limited audit, which is less extensive.

- Audit Waiver: Very small companies with fewer than 10 employees may waive audit requirements if shareholders agree.

This flexibility in audit requirements helps reduce administrative burdens for smaller businesses.

Example: A Foreign-Owned Consulting Firm Opening in Zurich

Imagine a UK-based consultancy that decides to establish an operational presence in Zurich to expand its services across Europe. The company opts for an AG structure, requiring CHF 100,000 in share capital, of which CHF 50,000 must be deposited into a capital contribution account. A Swiss resident is appointed as a director to oversee compliance and assist with regulatory filings.

As an operational company, the firm is subject to regular Swiss taxes on income generated within Switzerland and must also register for VAT if its annual Swiss revenue exceeds CHF 100,000. By establishing an operational company rather than a domiciliary one, the consulting firm gains the credibility needed to attract Swiss clients while fully complying with local regulations.

Final Checklist for Non-Resident Entrepreneurs

To ensure a smooth setup for your business in Switzerland, here’s a checklist to help you stay on track:

- Determine Your Business Structure

Decide between a domiciliary or operational company based on your business activities and goals. - Appoint a Swiss Resident Director

Ensure compliance by appointing a director with Swiss residency who can oversee legal and regulatory requirements. - Open a Capital Contribution Account

Deposit the required share capital in a Swiss bank to secure your company’s financial foundation. - Register for Tax and VAT

Consult with a tax advisor to ensure full compliance with Swiss tax obligations, especially if your business generates income within Switzerland. - Maintain Accurate Bookkeeping and Plan for Audits

Set up a system for accurate financial reporting and prepare for audits based on company size.

Conclusion: Starting Your Business Journey in Switzerland as a Non-Resident

Opening a business in Switzerland as a non-resident offers numerous advantages, from accessing European markets to benefiting from a stable and efficient business environment. By understanding the distinctions between domiciliary and operational companies, fulfilling residency and financial requirements, and adhering to tax obligations, foreign entrepreneurs can establish a successful and compliant business presence in Switzerland.

Switzerland’s transparent regulatory landscape may seem complex, but with the right preparation, your business can thrive in one of the world’s most reliable economies. Whether you’re planning to manage assets globally or build a local client base, Switzerland offers a secure foundation for your entrepreneurial ambitions.