Switzerland’s stable economy, high quality of life, and business-friendly tax system make it an attractive destination for entrepreneurs and new business owners. Understanding the Swiss corporate tax system is crucial for effective financial planning and maximizing available tax benefits. This guide offers an overview of the Swiss corporate tax landscape, covering core tax types, cantonal differences, compliance requirements, VAT changes, and Double Taxation Agreements (DTAs).

Overview of the Swiss Corporate Tax System

Switzerland’s tax system operates at both federal and cantonal levels, requiring businesses to comply with federal, cantonal, and communal taxes. This multi-tiered system includes corporate income tax (CIT), capital tax, and value-added tax (VAT), each impacting a company’s overall tax obligations.

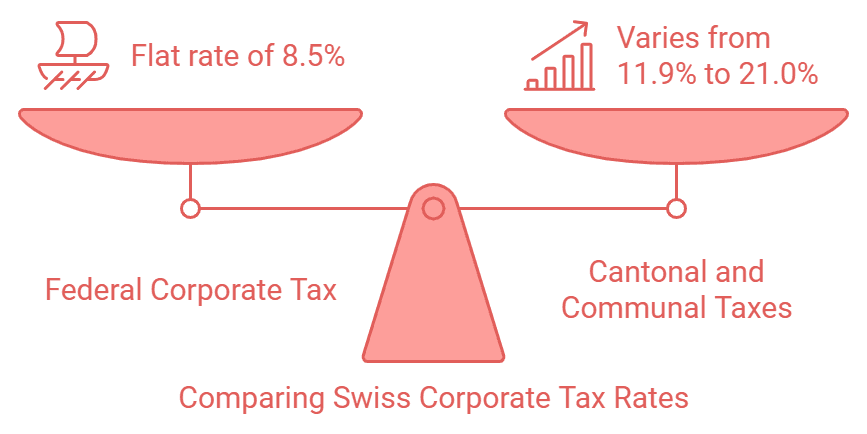

- Federal Corporate Tax (CIT): Levied at a flat rate of 8.5% on profit after tax, effectively reducing to about 7.83% on profit before tax due to CIT’s deductibility.

- Cantonal and Communal Taxes: Cantonal tax rates vary, with the total CIT rate (including federal, cantonal, and communal taxes) ranging from 11.9% to 21.0%.

- Capital Tax: Levied by cantons on net equity, this tax varies but typically represents a minor portion of a company’s tax burden.

This competitive structure, along with potential tax deductions, makes Switzerland particularly attractive to startups, SMEs, and larger corporations.

Key Tax Considerations for New Businesses

1. Corporate Income Tax (CIT)

Swiss companies are subject to CIT on Swiss-sourced income, with rates varying by canton. For instance, companies in Zug or Nidwalden benefit from some of the lowest CIT rates, while Zurich and Bern have higher overall rates.

2. Capital Tax

In addition to CIT, cantons impose a capital tax on a company’s net equity, which includes share capital, retained earnings, and open reserves. Though it contributes minimally to overall tax expenses, it’s important for companies planning to retain earnings or raise substantial capital.

3. Value-Added Tax (VAT)

Businesses with over CHF 100,000 in annual revenue must register for VAT. Beginning January 1, 2024, new VAT rates apply:

- Standard VAT rate: Increased from 7.7% to 8.1%

- Reduced VAT rate: Increased from 2.5% to 2.6%

- Special VAT rate for accommodation: Increased from 3.7% to 3.8%

These adjustments help fund social initiatives while maintaining a competitive tax environment.

4. Tax Deductions and Incentives

Switzerland offers multiple tax incentives:

- R&D Deductions: Certain cantons offer enhanced deductions for research and development expenses.

- Patent Box: Income from patents and intellectual property can be taxed at a reduced rate.

- Investment Incentives: Some regions provide tax breaks or deductions for investments in specific sectors, especially technology and pharmaceuticals.

Cantonal Tax Differences

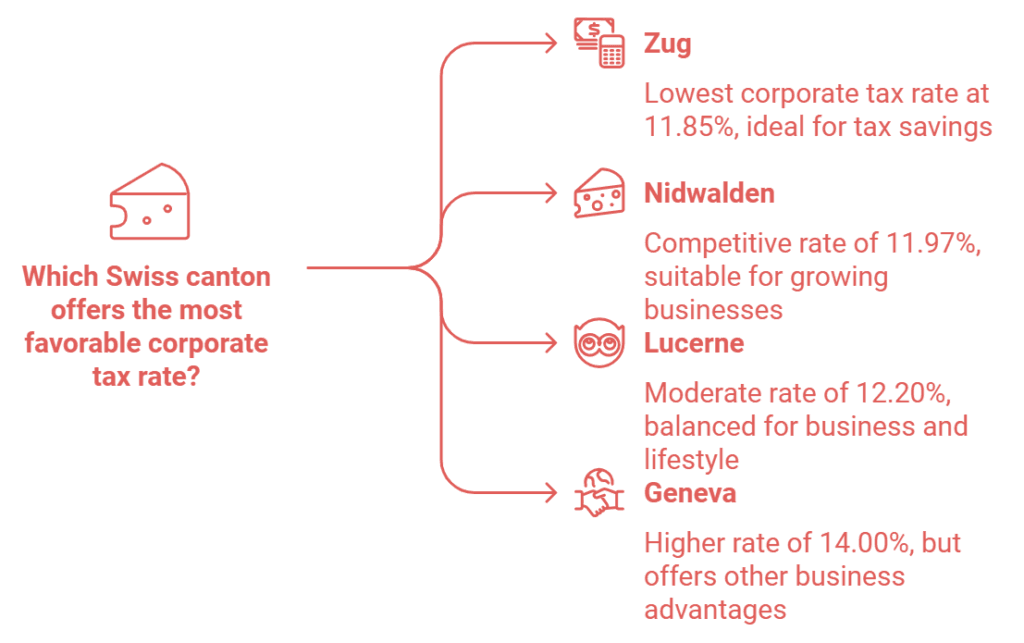

Switzerland’s cantonal tax differences provide businesses with options for minimizing tax burdens. Here are some of the cantons with the most attractive rates:

| Rank | Canton | Corporate Tax Rate |

|---|---|---|

| 1 | Zug (ZG) | 11.85% |

| 2 | Nidwalden (NW) | 11.97% |

| 3 | Lucerne (LU) | 12.20% |

| 4 | Glarus (GL) | 12.31% |

| 5 | Uri (UR) | 12.63% |

| 6 | Appenzell Innerrhoden (AI) | 12.66% |

| 7 | Obwalden (OW) | 12.74% |

| 8 | Appenzell Ausserrhoden (AR) | 13.04% |

| 9 | Basel-Stadt (BS) | 13.04% |

| 10 | Thurgau (TG) | 13.21% |

| 11 | Neuchâtel (NE) | 13.57% |

| 12 | Schaffhausen (SH) | 13.80% |

| 13 | Fribourg (FR) | 13.87% |

| 14 | Geneva (GE) | 14.00% |

| 15 | Vaud (VD) | 14.00% |

| 16 | Schwyz (SZ) | 14.06% |

| 17 | St. Gallen (SG) | 14.40% |

| 18 | Graubünden (GR) | 14.77% |

| 19 | Solothurn (SO) | 15.29% |

| 20 | Jura (JU) | 16.00% |

| 21 | Valais (VS) | 17.12% |

| 22 | Aargau (AG) | 17.42% |

| 23 | Basel-Landschaft (BL) | 17.97% |

| 24 | Ticino (TI) | 19.16% |

| 25 | Zurich (ZH) | 19.65% |

| 26 | Bern (BE) | 21.04% |

Source: Swiss Federal Tax Administration, as of June 28, 2024.

Double Taxation Agreements (DTAs): Avoiding Double Taxation for International Businesses

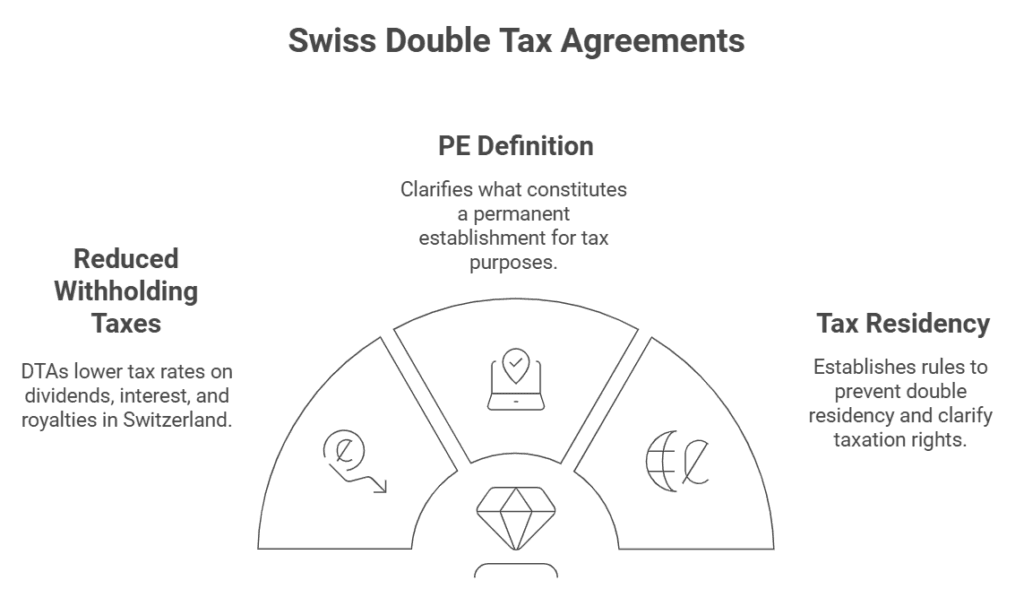

Double Taxation Agreements (DTAs) are treaties that Switzerland has established with various countries to prevent companies and individuals from being taxed on the same income in both Switzerland and another country. DTAs are essential for businesses engaging in cross-border activities, as they help reduce or eliminate double tax burdens on international income.

Key Features of Swiss DTAs

- Reduced Withholding Taxes: DTAs often lower withholding tax rates on dividends, interest, and royalties, making Switzerland a favorable location for holding companies.

- Permanent Establishment (PE) Definition: DTAs clarify what constitutes a “permanent establishment” (PE) in each treaty country, which determines where tax obligations arise.

- Tax Residency: DTAs establish rules for tax residency to prevent double residency situations and clarify which country has taxation rights.

Switzerland’s Current DTA Network

Switzerland has DTAs with more than 100 countries globally, including major trade partners such as the United States, Germany, France, China, and the United Kingdom. These agreements make Switzerland an attractive location for businesses operating internationally by reducing tax costs associated with global revenue.

A complete list of Switzerland’s DTAs is available on the Swiss Federal Tax Administration website. Companies with international business activities should review applicable DTAs to understand their tax benefits and seek advice from tax professionals to maximize treaty benefits.

Tax Compliance and Filing

New businesses in Switzerland should be aware of the following compliance requirements:

- Annual Tax Returns: Required at both federal and cantonal levels, with varying deadlines depending on the canton.

- Penalties for Non-Compliance: Failure to comply with tax obligations can lead to penalties, interest charges, or even legal consequences.

- Seek Professional Assistance: Engaging a tax advisor helps ensure accuracy, optimize tax planning, and maintain compliance.

Tips for Minimizing Corporate Taxes

To make the most of Switzerland’s tax-friendly environment, here are some strategies:

- Use Deductions and Incentives: Leverage R&D and patent box incentives, which can reduce taxable income.

- Choose a Tax-Competitive Canton: Selecting a low-tax canton such as Zug or Nidwalden can significantly reduce costs.

- Plan for Growth: Future expansion or restructuring may impact your tax position and potential incentives.

- Consult a Tax Professional: Professional advice can help you navigate the complexities of Swiss and international tax laws, especially regarding DTAs.

Conclusion: Setting Up for Success in Switzerland

Switzerland’s corporate tax system is highly attractive for businesses, offering competitive rates, deductions, and a robust network of Double Taxation Agreements (DTAs) to prevent double taxation on international income. By understanding Swiss corporate tax for businesses and implementing effective tax strategies, new business owners can position themselves for long-term success.

Whether you’re starting a new venture or expanding internationally, consider working with a tax advisor to fully benefit from Switzerland’s tax structure and DTAs. With the right planning, your business can thrive in Switzerland’s dynamic market.